Running a business today means knowing more than just your product or service—you need to understand how payments work. Whether it’s a coffee shop or an online boutique, accepting payments smoothly is essential for keeping customers happy and your business thriving. A key part of this system? The merchant ID number (MID). While it might sound technical, having a basic grasp of this number can make a big difference in how your business operates.

This guide will explain a merchant ID number, how it works, why it matters, and how to manage it effectively.

Let’s dive into the details!

What is a merchant ID number?

A MID is a unique identifier assigned to a business by a merchant acquirer. Think of it as your business’s payment processing ID card. It’s what payment systems use to recognize you when processing electronic transactions.

Your business can’t accept electronic payments like credit or debit cards without an MID. It’s the foundation of the payment processing system, ensuring every transaction is tracked and routed correctly. An MID also enables flexible payment options, thereby improving the customer’s shopping experience.

Why your business needs a merchant ID number

An MID number is not just a technical requirement—it’s a vital part of the payment process that businesses must have when accepting card payments. Without an MID, businesses couldn’t process payments or manage their financial transactions effectively.

Here’s why having an MID is essential:

- Accurate fund transfers

The MID ensures that funds from customer payments are accurately deposited into your business’s merchant account. When a customer makes a payment, the MID links that transaction to your business, ensuring the money flows into the correct account. Without it, payments wouldn’t be routed appropriately, causing delays and complications in receiving your funds. - Fraud prevention

Fraudulent activities in the payment system are a significant concern for businesses. The MID plays a crucial role in fraud prevention by allowing payment processors to verify transactions. When a payment is processed, the MID helps ensure the transaction is legitimate, reducing the risk of unauthorized charges and protecting the business and its customers. - Business identification

The MID serves as a unique identifier for your business in the payment ecosystem. It simplifies communication between your business, banks, payment processors, and card networks. The MID also helps streamline transaction processing, making tracking and managing payments, resolving disputes, and enhancing reporting accuracy easier. - Regulatory compliance

Maintaining compliance with payment industry standards is critical for businesses handling financial transactions. Having a merchant account and MID means your transactions are processed within systems that follow regulatory standards, including security measures and anti-money laundering protocols. With an MID, businesses can demonstrate that they follow proper industry practices and ensure the integrity of their financial operations.

Obtaining an MID

Usually, your payment service provider assigns a merchant ID number to your business when you apply for a merchant account. Below is a breakdown of the application process and the key factors that can affect the approval of your MID.

Choosing a merchant acquirer

The process starts with selecting a merchant acquirer. When selecting a merchant acquirer, there are several key factors to consider to ensure you make the right choice for your business:

- Fees: It’s crucial to compare transaction rates, merchant fees, setup fees, and monthly charges across different providers to find the most cost-effective option.

- Technology: Ensure the acquirer’s payment systems integrate seamlessly with your existing tools, such as point-of-sale (POS) terminals, online payment gateways, or e-commerce platforms.

- Customer support: Look for a reliable provider to quickly address issues, ensuring minimal disruption to your payment processes.

- Industry expertise: Choose an acquirer with experience in your specific industry. They will be better equipped to handle your business sector’s unique needs and challenges.

Tips for finding the right acquirer

- Read reviews and testimonials from other businesses to understand the provider’s reliability.

- Ask for quotes and carefully compare pricing structures to find the best deal.

- Negotiate terms to ensure flexibility and transparency in your contract.

Application process

Getting an MID involves a few straightforward steps:

- Choose a merchant acquirer: Look for one that aligns with your business’s payment needs, whether you operate online, in-person, or both.

- Submit your application: Provide your business name, address, bank account details, and other relevant documents, such as your tax ID or business license.

- Verification: The merchant acquirer reviews your application and evaluates your business for potential risks.

- Approval and issuance: If everything checks out, your MID is issued, and you can start processing payments.

Factors affecting MID approval

Several factors can influence MID approval, with your business type playing a critical role. Certain industries carry elevated operational, financial, or compliance risks, such as higher chargeback potential or regulatory scrutiny, which may lead payment processors to apply stricter evaluation criteria before granting approval. Additionally, your credit history plays a significant role in the approval process. A strong financial record can improve your chances of approval. Finally, ensuring your business complies with all relevant regulatory standards can help streamline the process and make approval more likely.

Fun fact:

Every business that accepts card payments has a secret identity – a unique code called a Merchant ID (MID). While often a powerful 15-digit alphanumeric sequence, this digital fingerprint ensures your payment lands exactly where it’s supposed to, like a high-tech mailing address for your money.

Managing your merchant ID

Managing your MID effectively is crucial to maintaining your payment systems’ security and smooth operation. By following best practices and staying on top of account updates and troubleshooting, you can minimize disruptions and enhance the safety of your business transactions.

Security best practices

Keeping your MID secure is essential to avoid fraud and protect your business. Always use strong, unique passwords for your payment systems and limit access to authorized employees only to ensure its safety. Regularly conduct security audits to identify and fix vulnerabilities, and educate your team on secure payment handling practices. By prioritizing these actions, you can safeguard your MID and reduce the risk of security breaches.

Updating your account

It’s essential to keep your merchant account up-to-date with accurate information. If your address, bank account, or contact details change, update them immediately. Failing to do so could lead to transaction issues or delays, disrupting your payment processing and affecting your business.

Troubleshooting issues

If you encounter challenges like declined transactions or system errors, take these steps to troubleshoot:

- First, check for any technical issues with your payment system.

- Next, confirm that your MID is active and correctly configured.

- If the issue persists, contact your merchant acquirer for support. They can assist you in resolving more complex issues and ensuring smooth payment processing.

Can you have multiple merchant ID numbers?

Yes, businesses can have multiple MID numbers. Here’s when having multiple MIDs makes sense:

- Different business locations

If your business operates in multiple locations, separate MIDs help track revenue streams by location. - Diverse business operations

A company with distinct divisions, such as a retail store and an online shop, may benefit from unique MIDs for each division.

While multiple MIDs add complexity, they enhance financial transparency and organization.

How to find your merchant ID

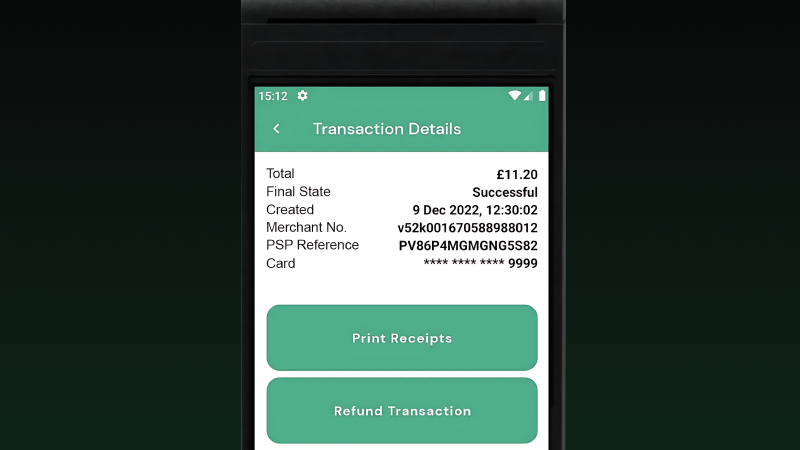

Your merchant ID isn’t publicly available for security reasons. However, you can locate it through several methods:

- Merchant account statement

Look for the MID on the top corner of your monthly statement. - Payment terminal

Many credit card terminals display the MID on their stickers or device labels. - Bank statements

Your regular business bank statement might include the MID alongside transaction details. - Contact your provider

If all else fails, reach out to your payment processor or acquiring bank.

Risks of losing your merchant ID

Losing access to your Merchant ID (MID) can severely disrupt your business and its ability to process payments. Here’s how losing your MID can happen:

- Excessive chargebacks

A high chargeback rate occurs when customers dispute charges, leading to financial loss for your business. If your chargeback rate becomes too high, your payment processor may terminate your merchant account, revoke your MID, and halt payment processing. - Fraud suspicion

Your payment processor may suspend your account if your business is suspected of engaging in fraudulent activities or processing suspicious transactions. This could result in losing your MID and preventing you from accepting card payments until the issue is resolved. - Non-compliance

Failure to meet industry regulatory standards or comply with the payment processor’s terms and conditions can revoke your MID. Non-compliance with security protocols, like PCI-DSS standards, may lead to penalties or account suspension.

To avoid these risks, it is crucial to monitor your chargeback rate, maintain good standing with your payment processor, and ensure your business remains compliant with all necessary regulations.

Conclusion

A Merchant ID Number is more than just a code—it’s the lifeline of your business’s payment ecosystem. By understanding its importance, managing it effectively, and protecting it from risks, you can ensure uninterrupted operations and financial stability for your business.

If you’re setting up or optimizing your payment processes, prioritize the security and accuracy of your MID. It’s not just about getting paid—it’s about building trust with your customers and payment partners.

FAQs

1. Can a business have more than one MID?

Yes, businesses with multiple locations or departments often use separate MIDs to track transactions more effectively.

2. What should I do if my MID is compromised?

Contact your merchant acquirer immediately to secure your account and prevent unauthorized transactions.

3. How long does it take to get an MID?

The process usually takes a few days to a week, depending on your acquirer and the complexity of your application.

4. Are there fees associated with having an MID?

Yes, most merchant acquirers charge fees for processing transactions, including per-transaction fees, monthly charges, or setup costs.

5. What happens if I change my business structure or location?

You’ll need to update your merchant account details with your acquirer to ensure uninterrupted payment processing.

Sources

1. What Is Electronic Transaction | CitizenSide

2. What Is a Chargeback? Definition, How to Dispute, and Example