Let’s start with a hypothetical scenario.

Imagine an online market called Global Groceries.

Amelia in New York yearns for exotic mangosteens from Vietnam. She orders from Global Groceries. A hefty cross-border fee dampens her excitement, forcing her to abandon her cart.

Meanwhile, Vietnamese farmer Mr. Linh’s joy at an American order shrinks as he sees the high transaction fees. Global Groceries suffers as customers and sellers flee the high costs and complexities of international transactions.

This is the cross-border payment reality. Now, we have On-Chain payments, which simplify borderless transactions.

In this article, we’ll discuss On-Chain Payments’ role in global, borderless transactions. We’ll also highlight On-Chain Payments on APS.

Mastering on-chain payment for borderless payments

On-chain payments change how businesses handle cross-border transactions. But how do they work, and what makes them so advantageous? Let’s first define On-Chain Payments, explore its technology, and discover its business application to improve borderless transactions.

Understanding on-chain payments

On-chain payments refer to transactions recorded directly on the blockchain. These payments utilize digital currencies to transfer value between parties. The entire transaction process, from initiation to confirmation, is visible on the blockchain, providing a transparent and immutable record.

Did you know?

Blockchain is decentralized, meaning no single entity controls the entire network. Each transaction is recorded in blocks linked together to form a chain—hence the term blockchain.

So, how do On-Chain Payments work?

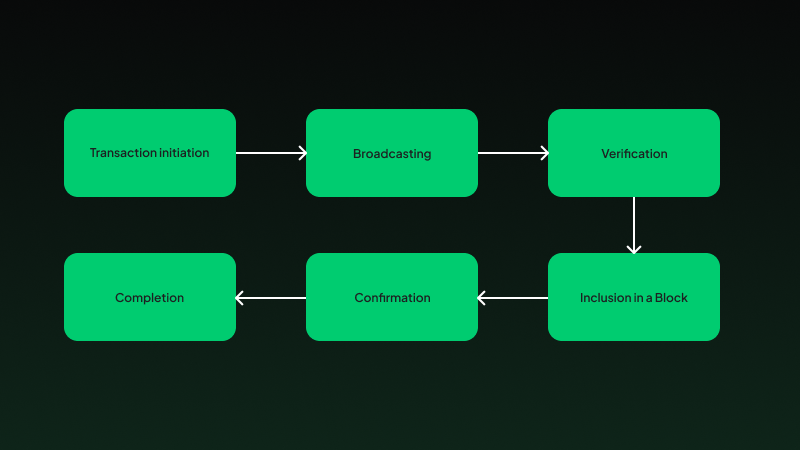

The on-chain payment flow

On-chain payments involve the buyer creating a transaction request, which the network broadcasts and verifies. Verified transactions are grouped into blocks added to a secure blockchain ledger, crediting the recipient’s wallet.

On-chain payments offer several key benefits for businesses:

- Transactions are settled almost instantly.

- On-chain payments have low transaction costs.

- Businesses reach more clients without limitations imposed by banking systems.

- Blockchain provides a tamper-proof transaction record, ensuring transparency and security.

Simplified borderless payments for businesses

The beauty of On-Chain Payments lies in their borderless nature, making them fundamental for various business models.

- E-commerce businesses selling internationally

On-chain payments eliminate the hefty fees and complexities of traditional cross-border transactions, allowing businesses to expand their reach to a global audience without sacrificing profits.

- Freelance marketplaces with global reach

Platforms connecting freelancers with clients worldwide can leverage On-Chain Payments to ensure fast, secure payments for both parties. For example, an Indian web developer can receive payment from a US marketing agency.

- Subscription services with international customers

On-chain payments offer a reliable and cost-effective way to collect recurring payments from subscribers around the globe. A language learning app can provide its service to students in any country, with the app and students benefiting from transparent and efficient transactions.

With its clear benefits, how can businesses adopt the borderless payment solution?

Choosing the right on-chain payment solution

Businesses can start by identifying an On-Chain Payment partner that compliments their services. However, let’s first highlight the On-Chain Payment services providers.

Different on-chain payment providers

- Digital currency exchanges: These platforms, like Binance, allow businesses to accept and process payments in various digital currencies. They also provide wallet services and can convert digital currencies into fiat.

- Blockchain payment processors: Companies like APS offer specialized services for handling digital currency payments. They provide tools for merchants to accept digital currencies and often include features like invoicing and real-time conversion rates.

- Decentralized finance (DeFi) platforms: DeFi platforms like MakerDAO enable on-chain transactions with additional financial services, such as lending and borrowing, providing more comprehensive financial solutions.

Having highlighted them, here’s a comprehensive guide to help you choose the right provider:

| Criteria | Description |

|---|---|

| Supported currencies | Ensure the provider supports the digital currencies relevant to your business and target market. |

| Integration capabilities | Check how easily the provider’s solution integrates with your existing systems. Compatibility with various e-commerce platforms and point-of-sale systems is a plus. |

| Customer support | Assess the customer support quality. Reliable, 24/7 customer service is essential for resolving issues promptly. |

| Regulatory compliance | Verify that the provider complies with relevant regulations, ensuring legal operation and protecting your business from potential legal issues. |

| Reputation and reviews | Research the provider’s reputation. Look for reviews and testimonials from other businesses to gauge the service reliability and performance. |

Security considerations when choosing a payment partner

Security is paramount when dealing with On-Chain Payments. Opt for providers with strong security protocols, including:

- Multi-signature wallets: They require multiple private keys to authorize a transaction, adding an extra security layer.

- Encryption: Ensure data is encrypted in transit and at rest to protect against unauthorized access.

- Two-factor authentication (2FA): It increases account security, requiring users to verify their identity through another method.

Selecting reputable providers with a proven track record can mitigate risks and enhance transaction security.

Think about scalability and future growth

When selecting an On-Chain Payment solution, consider its scalability. As your business grows, the payment solution should be able to handle increased transaction volumes without compromising performance. Look for providers with:

- Robust infrastructure: Capable of supporting high transaction volumes.

- Flexible plans: Offering scalable pricing models that align with your business’s growth.

- Ongoing development: Commitment to continuous improvement and adaptation to new technological advancements.

By considering these factors, you can select an On-Chain Payment solution that will support your business through reliable payments.

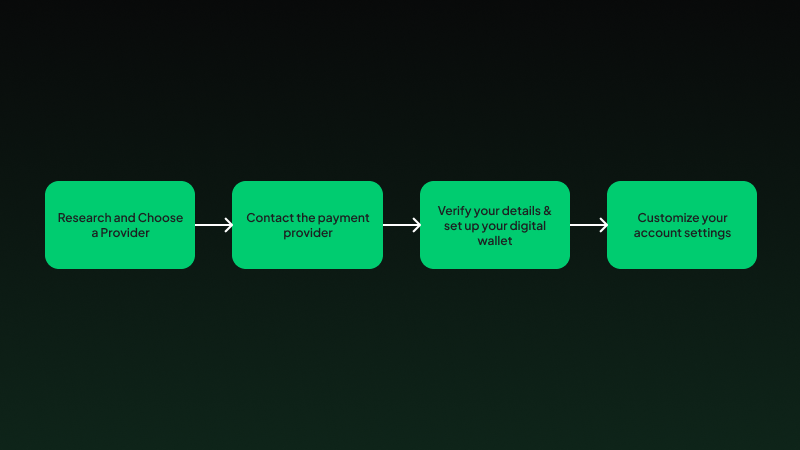

A guide on implementing on-chain payments

On platforms like APS, a dedicated accounts manager will take you through the integration and implementation processes. Here’s a general flow of adopting the payment methods.

- Visit the provider’s website and sign up for an account.

- Complete the verification process. You must submit identification and business verification documents to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Set up your digital wallet.

- Customize your account settings, including notification preferences, security features (e.g., enabling two-factor authentication), and integration options.

So, say you’ve set up On-Chain Payments with APS; what expectation should you have?

- APS leverages the Stellar blockchain ecosystem to facilitate global transactions, allowing businesses to pay and get paid in various digital currencies.

- We use Stellar’s SEP protocols to enhance Web3 application payment flows, ensuring multi-currency interoperability.

- APS supports several blockchain networks, including Stellar, Solana, Binance Smart Chain, and Ethereum, among others. The support simplifies the payment process for centralized finance (CeFi) and decentralized finance (DeFi), providing fluid blockchain transactions for over 60 settlement layer blockchains.

Once you’ve integrated our payment solution, you should notify your clients and train your support staff.

Educating clients about on-chain payments

Clearly display the option to pay with digital currencies at checkout. Provide concise instructions on how to use On-Chain Payments. Additionally, there should be an FAQ section, blog posts, or video tutorials explaining the On-Chain Payment benefits and how to complete a transaction. Inform your customers about the new payment option through newsletters, social media, and website banners.

Customer support for on-chain transactions

- Train support staff: Ensure your customer support team is well-trained in handling On-Chain Payment inquiries. Provide detailed information on common issues and solutions.

- Dedicated support channels: Set up dedicated channels for On-Chain Payment issues, such as a specific email address or phone line.

- Self-help resources: Offer self-help resources like a detailed troubleshooting guide, a comprehensive FAQ section, and community forums where customers can find answers to common questions.

And with that, you’re equipped to leverage On-Chain Payments in a borderless world to grow your business.

FAQs

What are On-Chain Payments?

On-chain payments are transactions recorded directly on the blockchain, a decentralized ledger. A network of nodes validates each transaction and becomes a permanent, transparent part of the blockchain. On-chain payments ensure high security, transparency, and traceability, as every payment is publicly verifiable and immutable once confirmed.

What are cross-border payments?

Cross-border payments refer to transactions where the payer and the recipient are located in different countries. These payments involve converting one currency into another. Borderless payments are essential for international trade, remittances, and global business operations. Payment processing is done through banks, payment gateways, and digital wallets.

How cross border payments work?

Cross-border payments work by transferring funds between financial institutions in different countries. The process involves currency conversion, intermediaries, and compliance with international regulations. Banks or payment providers use networks like SWIFT or blockchain to facilitate these transfers, ensuring the recipient receives the funds in their local or desired currency.

What are On-Chain Payments on APS?

On-chain payments on APS are a way to send and receive money using digital currencies. They use the Stellar blockchain to make payments fast, cheap, and secure. This system connects different currencies and lets people pay each other across borders.

Sources