Conventional payment security is failing. Relying on outdated methods risks your business’s customer data and revenue. With cyber threats increasing and breaches making headlines, tokenization is a necessary upgrade to protect every transaction.

Running an international online store requires a secure and efficient payment system, especially when handling card transactions. Clients expect speed, while businesses must prevent fraud, maintain compliance, and safeguard sensitive data.

So, how do businesses adapt to the modern payment experience clients demand? Well, through payment tokenization.

This guide explains how tokenization benefits an online retailer that processes numerous payments daily Through possible applications, we’ll show how it strengthens security, simplifies transactions, and improves the customer experience.

Understanding payment tokenization

Payment tokenization is a method that replaces sensitive payment information with a randomly generated string of characters known as a token. Businesses retain tokens in place of actual card details, using them as placeholders during transactions. Because tokens contain no exploitable card information, risks associated with unauthorized access and fraudulent activities are reduced.

Tokenization addresses two key concerns:

- Data protection: Sensitive payment details are less exposed when substituted with tokens that hold no value if intercepted.

- Transaction safety: Avoiding the storage of actual card numbers within a company’s systems lowers the likelihood of data breaches and fraud incidents.

Such an approach proves particularly useful for companies processing high volumes of card transactions, including international chain stores operating across diverse markets and regulatory environments.

Below, we explain payment tokenization using GlobalMart, a hypothetical international store.

How an international online store uses tokenization

GlobalMart, an international retailer selling electronics and fashion items, accepts payments from customers in over 50 countries. The company offers multiple payment methods, but card payments remain the most popular.

Handling thousands of transactions daily means dealing with large volumes of sensitive payment data. Without proper security measures, this could expose customers to fraud and create compliance risks for the business.

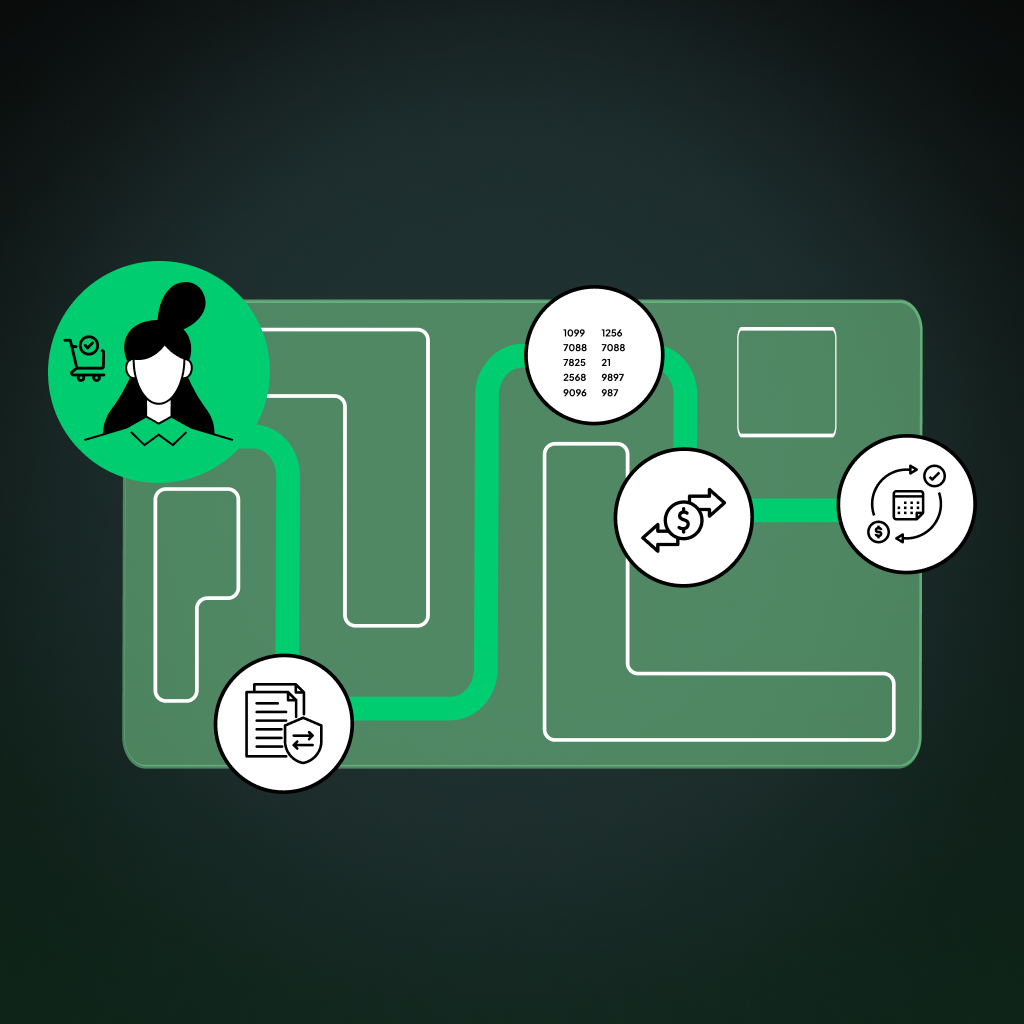

To protect payment details and maintain customer trust, GlobalMart integrates a tokenization system through its payment service provider. Whenever a customer enters card details, the system replaces them with a unique token before storing or processing the transaction. The actual card numbers are never saved on GlobalMart’s servers, reducing the risk of data theft or misuse.

Tokenization in practice

Let’s break down how tokenization functions within GlobalMart’s checkout process:

The client journey

1. Initial order placement

A corporate buyer from a large enterprise logs onto the GlobalMart portal to purchase a bulk order of electronic devices for their regional offices. The buyer enters the necessary card details for payment while selecting invoice processing and delivery options.

2. Data transmission

The buyer submits payment information. A tokenization service securely transmits the data and strongly encrypts the sensitive details during this transfer. This step prevents data interception during the communication between the chain store’s website and the tokenization provider.

3. Token generation and storage

The tokenization service generates a unique token using advanced algorithms. This randomized string represents the buyer’s card information but lacks any inherent meaning. GlobalMart receives and stores the token in the customer’s profile for future transactions. The actual card details are maintained in a secure vault complying with industry security standards.

4. Transaction completion

After processing the payment, the chain store returns the token to the payment processor. Subsequently, the processor accesses the secure vault, retrieves the corresponding card information, and authorizes payment. Finally, the corporate buyer receives transaction confirmation and processes the order for shipment.

5. Recurring transactions

GlobalMart also offers subscription-based services to some corporate clients. For instance, a company might subscribe to a monthly office supply service. The token generated during the initial transaction is reused for each recurring payment, reducing the need for repeated data entry.

The internal process flow

Within GlobalMart, the technical integration of tokenization occurs as follows:

- Integration with existing systems

The chain store’s e-commerce platform is configured to interact with a tokenization service through secure application programming interfaces (APIs). The tokenization service is selected based on its adherence to international security standards and ability to handle multiple currencies and transaction types.

- Data management

The chain store’s internal systems are designed to hold tokens instead of full card numbers.

- Compliance and auditing

Regular audits and compliance checks verify that the tokenization process meets the required payment industry standards. GlobalMart simplifies compliance with payment security regulations across different markets by relying on a secure tokenization service.

- Employee training

Staff responsible for managing the payment systems receive thorough training on tokenization and the importance of adhering to security protocols. This training minimizes human error and reinforces the company’s overall security strategy.

Why tokenization is critical for online retailers

Let’s examine various scenarios to highlight why online businesses need tokenization.

Preventing fraud and data breaches

An online store handling thousands of card transactions is a target for fraudsters. Hackers accessing stored card details can use them for unauthorized purchases. However, since tokenization replaces sensitive data with meaningless values, stolen tokens cannot be used for fraudulent transactions.

Example:

Suppose GlobalMart experiences a data breach where attackers access stored payment records. Instead of finding real card numbers, they only retrieve tokens like “XvbgVir9B27xt.” Since these tokens are meaningless outside GlobalMart’s system, fraudsters cannot use them for any other purpose.

Improving customer experience with faster checkout

Online shoppers expect a fast and convenient payment process. If customers have to enter their card details every time they make a purchase, they may abandon their carts. Tokenization offers businesses a one-click checkout experience by securely storing payment details as reusable tokens.

Example:

Emma, a returning customer, wants to buy a new smartphone from GlobalMart. Instead of entering her card details again, she selects her saved card, and the system processes the transaction using the stored token. This speeds up the checkout process, making the shopping experience smoother.

Supporting recurring payments and subscriptions

Secure storage of payment details is essential for businesses offering subscription-based products. Tokenization enables automatic payments without requiring customers to re-enter their card details.

Example:

GlobalMart introduces a subscription plan for premium members, providing exclusive discounts and early access to new products. Customers who subscribe authorize recurring payments using their card. The system generates a token linked to their card details, allowing automatic monthly payments without storing actual card numbers.

Improved security for cross-border transactions

An international store deals with customers from different regions with varying fraud risks. Payment tokenization helps secure cross-border transactions by reducing card data exposure across multiple payment networks.

Example:

GlobalMart receives an order from a customer in Japan. The payment is processed through a local bank, but the tokenization system ensures that no real card details are transmitted across international networks. This reduces the risk of data interception and unauthorized access.

Enhancing payment approval rates

A false decline occurs when a legitimate transaction is mistakenly flagged as fraudulent. This is a common issue in payment processing, but it comes with consequences—lost revenue, frustrated customers, and the risk of negative reviews.

Payment tokenization helps address this problem by providing banks and payment processors with more accurate transaction data. Network tokens are merchant-specific, meaning a business with a strong transaction history is not affected by another merchant experiencing fraud-related issues. As a result, fraud detection systems can more effectively differentiate between genuine and suspicious transactions.

Fewer false declines also mean better fraud monitoring. Businesses can refine their fraud detection capabilities over time by integrating transaction data into machine learning models. The more accurate the system becomes, the better it can protect against actual fraud while reducing unnecessary transaction blocks.

How tokenization works with different payment methods

Below are the variations in tokenization based on card payments and digital wallets.

1. Bank Transfers (ACH, Wire Transfers, SEPA, etc.)

For bank transfers, including ACH, wire transfers, and SEPA payments, tokenization replaces bank account details with a tokenized reference. This is especially useful for recurring payments and direct debits, as it eliminates the need to store or transmit sensitive banking information, minimizing exposure to fraud.

2. Digital currencies

Digital asset transactions use encryption rather than traditional tokenization, but some services tokenize assets to create digital representations of real-world funds. While public keys (wallet addresses) remain visible, private keys are securely stored, ensuring secure and anonymous transactions. Tokenized digital currencies enhance security and enable safer digital asset exchanges.

3. Bank-based payment systems

In bank-based payment systems like UPI, open banking, and direct debit, tokenization prevents directly sharing account numbers. Customers authenticate transactions through tokenized processes, ensuring that only the necessary data is transmitted securely.

4. Card payments

The most common use of tokenization is with card payments. When customers enter their card details, the system generates a token that replaces the card number during transactions.

5. Digital wallets

Digital wallets rely on tokenization to protect payment details. When a customer uses a digital wallet, a token is created and linked to their device, preventing real card numbers from being stored. For example, a customer uses a digital wallet to buy headphones from GlobalMart. The payment system processes the transaction using a token, ensuring the card number remains hidden from the retailer and potential hackers.

Securing growth with smarter payments

For companies growing beyond their local markets, secure payment processing is more than a feature—it is essential. Customers want a fast, protected checkout experience, and businesses handling large transactions require systems that reduce risk.

Tokenization helps maintain strong payment security without slowing down business expansion. Businesses handling one-time sales or recurring B2B payments can lower fraud risks while keeping transactions efficient.

With digital transactions rising, companies leveraging tokenization can strengthen fraud protection, simplify compliance, and enhance their clients’ overall payment experience.

Source

1. What is Encryption and How Does it Work? | Definition from TechTarget

2. What is an API (Application Programming Interface) – GeeksforGeeks